But with so many Americans already losing their main source of income – their jobs – at an ever-spiraling rate, will an economy that derives two-thirds of its power from consumer spending end up mired in its worst funk in decades because those same consumers are now losing their charge accounts?

But with so many Americans already losing their main source of income – their jobs – at an ever-spiraling rate, will an economy that derives two-thirds of its power from consumer spending end up mired in its worst funk in decades because those same consumers are now losing their charge accounts?The U.S. economy weakened across all regions since the middle of October as it became tougher to get loans and demand for credit shrank, the U.S. Federal Reserve said in its regional economic survey report yesterday (Wednesday). The so-called “Beige Book” report – published just two weeks before central bank policymakers are to meet and consider interest-rate changes – said that retail sales, tourism spending and manufacturing declined in most places, labeled housing markets as “weak” and concluded that the commercial real estate sector “weakened broadly,” Bloomberg News reported.

We are looking at an economy that is not only in a recession, but a recession that is deepening rapidly,” former Fed Governor Lyle Gramley, now senior economic adviser at Stanford Group Co., told Bloomberg Television.

This economic one-two punch could generate a much-bigger financial crisis “aftershock” than many experts realize. Only two of the last 10 recessions to take place since the Great Depression have lasted a full year. But this one could last well into 2010. To fully understand the forces at play, let’s first look at the outlook for U.S. employment.

Non-farm payroll employment fell by 240,000 in October, and the unemployment rate jumped to 6.5%, up from 6.1% the month before, the Bureau of Labor Statistics reported in early November. October’s drop in payroll employment followed declines of 127,000 in August and 284,000 in September. That means that U.S. employment has fallen by 1.2 million jobs in the first 10 months of the year, with more than half of that decrease occurring in August, September and October. The government’s jobless numbers for November won’t be released until tomorrow (Friday) – although it’s expected to show that the U.S. economy lost jobs for the 11th straight month, Bloomberg News reported.

The ADP report prompted some analysts to boost their estimates for the job losses we’ll see in tomorrow’s Labor Department report. New predictions include a payroll decline of 400,000 from Goldman Sachs Group Inc. (GS) and a drop of 450,000 from Wachovia Corp. (WB) economists. And the unemployment rate for November probably spiked to 6.8%, the highest it’s been since 1993.

According to a number of estimates, the U.S employment outlook – and the overall economy – is going to get much worse before it gets better. Goldman Sachs Group Inc. (GS) says the U.S. unemployment rate will spike to 9.0% by the fourth quarter of 2009, as corporate profits plunge an estimated 25% – and that’s after an estimated decline in profits of about 10% this year, Goldman says. Indeed, the U.S. economy – as measured by gross domestic product (GDP) – will decline by 5.0% in the current quarter, followed by declines of 3.0% in the first quarter of 2009 and 1.0% in the second quarter, Goldman predicts.

The U.S. Commerce Department estimated that U.S. GDP rose 0.9% in the first quarter and 2.8% in the second quarter. For the third quarter, GDP declined an estimated 0.3%.

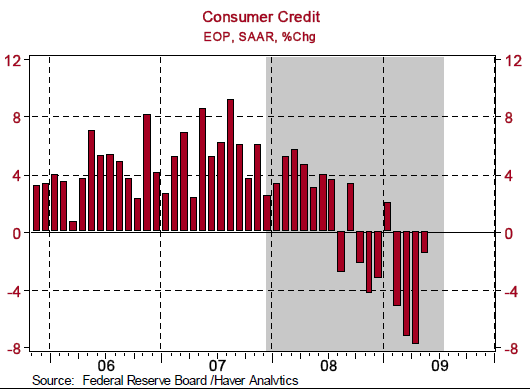

More than $2 trillion in consumer credit could be cut in the next 18 months, as credit-card companies pull back credit lines in anticipation of credit funding problems and regulatory changes, said Meredith Whitney, an Oppenheimer Holdings Inc. (OPY) banking analyst who’s well-known for her gutsy and prescient (and ultimately correct) market calls.

“What you haven’t seen yet digested by the market is banks pulling lines from consumers,” Whitney said in an interview with CNBC. “And across the board you saw the big banks that command so much of the market share of key products like mortgages and credit cards start to pull lines in the third quarter and that’s going to continue in the fourth quarter. And that’s going to continue into 2009.”

During dire times, many consumers can boost their use of credit even as they cut overall spending, using the credit cards, home-equity lines and other forms of borrowing as a lifeline to tide them over. For those consumers, a credit line cut can be disastrous personally, and can aggregate into an even-steeper downturn in spending.

Roughly 70% of U.S. households have access to credit cards, and 90% of those people use those credit cards as a cash-flow management vehicle, or revolve payments at least once a year, Whitney says.

A surprisingly small number of national companies dominate the major lending arteries – including credit lines, mortgages and credit cards – that have sustained the U.S. consumer for so long, including mortgages and credit cards. Mortgages have already hit a wall with the collapse of the U.S. housing market and wave of subprime defaults. But credit cards could be next as companies raise interest rates, tighten lending standards, cut credit lines, and even close millions of accounts in an effort to insulate themselves from consumer defaults.

“What is actually taking place is a shift in consumer psychology that has been driven by factors such as the socioeconomic climate – as well as the environment – and that’s now being compounded by credit conditions,” Gilani said. “This is about banks and credit companies de-leveraging and forcing the American consumer to do the same.”

The trouble is, he said, this can become a cycle that’s hard to stop once it takes hold.

“Whether Americans have lost confidence in the market or simply can’t afford to repay loans, money flows have simply dried up” Gilani said. “So banks have been forced to raise their lending standards to a point that many Americans are now unable to meet. It becomes a vicious cycle.”

0 comments:

Post a Comment